Our fundraising history

Tremendous is profitable and wholly owned by founders and employees.

Tremendous has no outside investors.

You're probably here to understand how Tremendous is financed. We're profitable and operate our business through our cash flows. For technology companies, this is rare. Here's a quick company history to understand how it went down:

2011

Back when we were named GiftRocket, we raised a $500K seed round from Y Combinator and angel investors.

2012

GiftRocket becomes profitable and sustainable. This was great for our team, but growth was too slow for our investors.

2013

GiftRocket buys out its investors, doubling their initial investment. Investors are satisfied.

Now

We've been wholly owned by founders and employees since 2013. We're in hypergrowth mode, without VCs.

VC comes with strings attached

Venture capital is the typical way to get the money to grow a startup until it's profitable or exits. But you give up a lot by taking VC money, and not just a large portion of ownership shares. VCs have different risk tolerances than founders and employees. They make 30+ investments per fund, with the expectation that a few will make huge returns on a certain timeline and the rest will fail.

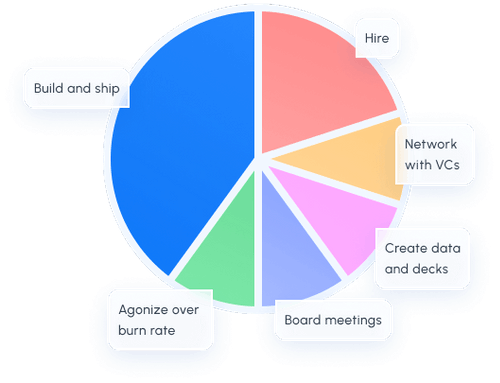

When you're raising money and satisfying investors' anxieties, you often prioritize metrics with short-term impact at the expense of the company's long-term health. Plus, that's a whole lot of time and brainpower spent on presentations and spreadsheets and meetings that we'd rather spend improving the product and acquiring customers. (Or simply shutting the laptop at a reasonable hour.)

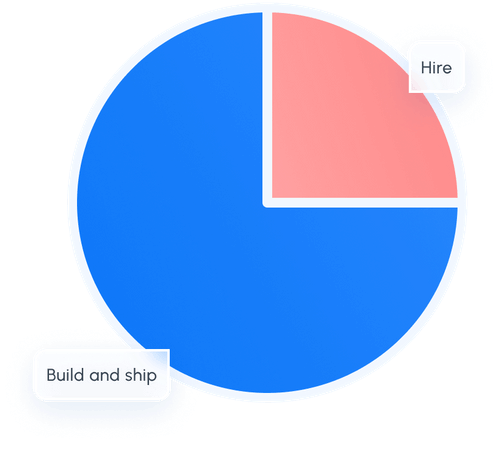

Without VC

With VC

There's a better way, if you're lucky enough

With the good fortune of product-market fit and a working business model, we chose to avoid VCs and instead to bootstrap, applying years of hustle and patience. Now we're in a great position: cash flow to enable big growth, without the burdens of outside investment. Most startups don't get this option to self-finance.

We're not militantly anti-venture. We just recognize that raising and taking money has hidden costs, and are thankful that we're in a position where we don't have to worry about it. We prefer to optimize for the long-term success of the company and its employee-owners.

We're in good company

This is a rare, but proven model. Here are a few companies who have bootstrapped their way to unicorn status...

Github didn't raise until 5 years after it was founded, and was acquired for $7.5B

Zapier took in a tiny seed round, and is now valued at $5B.

Notion raised a tiny seed round, became profitable, and raised their first VC round at a $2B valuation.

Calendly raised $550K and is now valued at $3B.

The next chapter

Though we aren't capital constrained, we are limited by our team size. We're hiring across all departments. If you're interested in working at a profitable, high-paying, fast-growing company, join us.

Join Us