Identify and prevent class action fraud

Fraud slows case disbursements and dilutes class funds. Learn how to spot suspicious patterns and defend your settlement.

From one-off grifts to organized crime

Fraudulent class action claim filings used to involve manual effort from single scammers.

Now, criminal enterprises use bots and other automated tools to submit thousands of fake claims in minutes. That means less money goes to legitimate class members.

Class action cases present a compelling fraud target

$42B

cumulative value of class action settlements in 2024 alone

10

class action cases settled for at least $1 billion each in 2024

22.8%

of claims show indicators of potential fraud

What makes scammers target class action settlements

Three common characteristics make cases especially attractive to fraudsters:

Public advertising

Extensive media coverage and third-party website promotions increase risk.

High dollar amounts

High-value settlements draw targeted attacks from fraudsters looking to cash in.

Lack of verification

Limited identity checks on claimants allow repeated batch submissions.

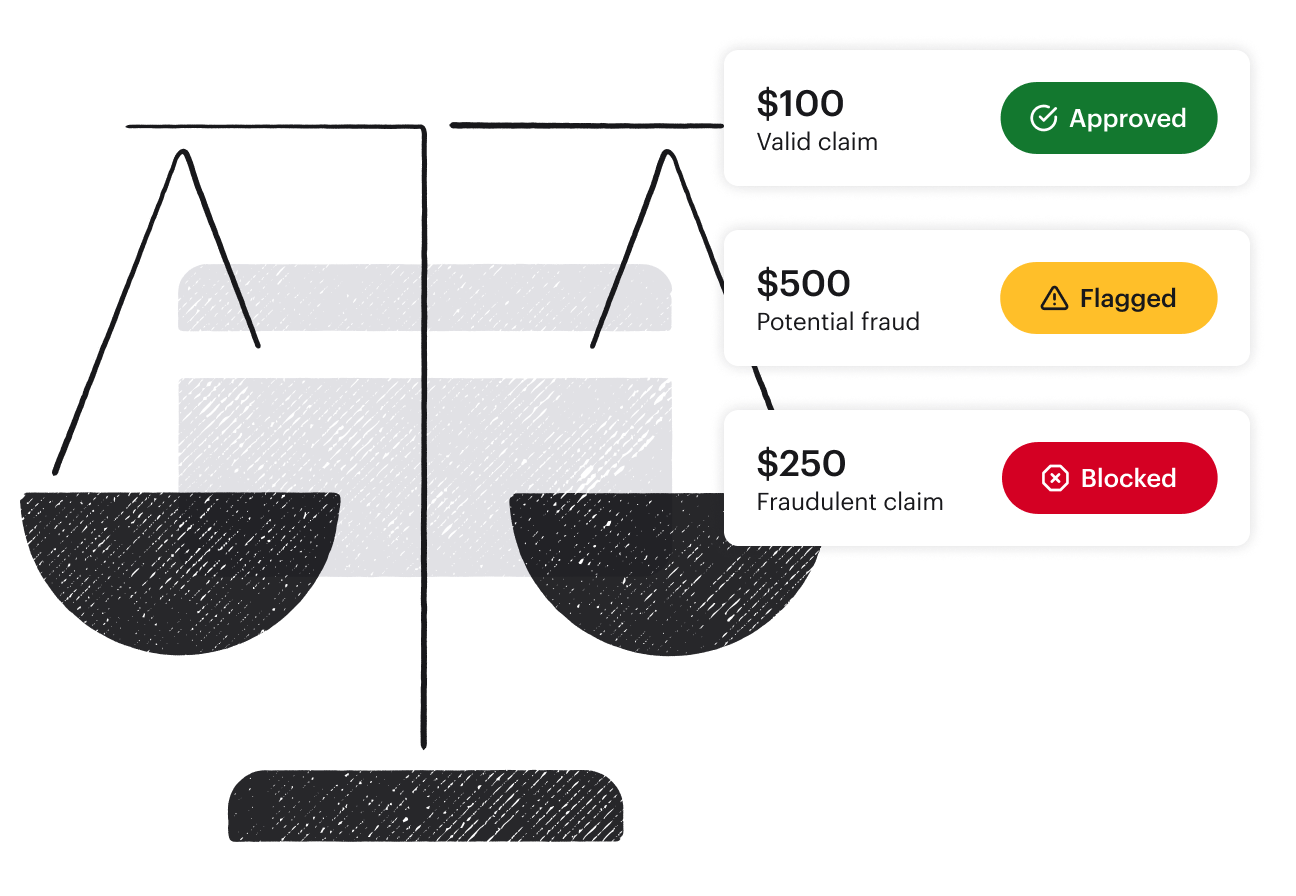

Protect your settlement funds with layered safeguards

Use multilayered fraud-prevention tactics:

Flag duplicate payment information

Look for repeated bank details or claimant addresses.

Watch for throwaway domains

Email addresses with unfamiliar domains can be a sign of automated activity.

Choose tools with built‑in fraud protection

Platforms like Tremendous can screen submissions and flag questionable payouts for review.

Explore class action fraud trends

Our latest report explores the prevalence of fraud across different case types and identifies the most common signals.