4 rules for revitalizing the healthcare market research participant pool

By Jennifer G Hall, Vice President of Research Operations at KJT|5 min read|Updated Oct 19, 2023

The Internet ushered in a boom era for online healthcare market research. Decades later, it’s clear that the very same web-based tools and outreach that afforded us easy access to doctors, nurses, and other healthcare professionals might also be our downfall.

But we have an opportunity, as an industry, to come together and reverse the trajectory.

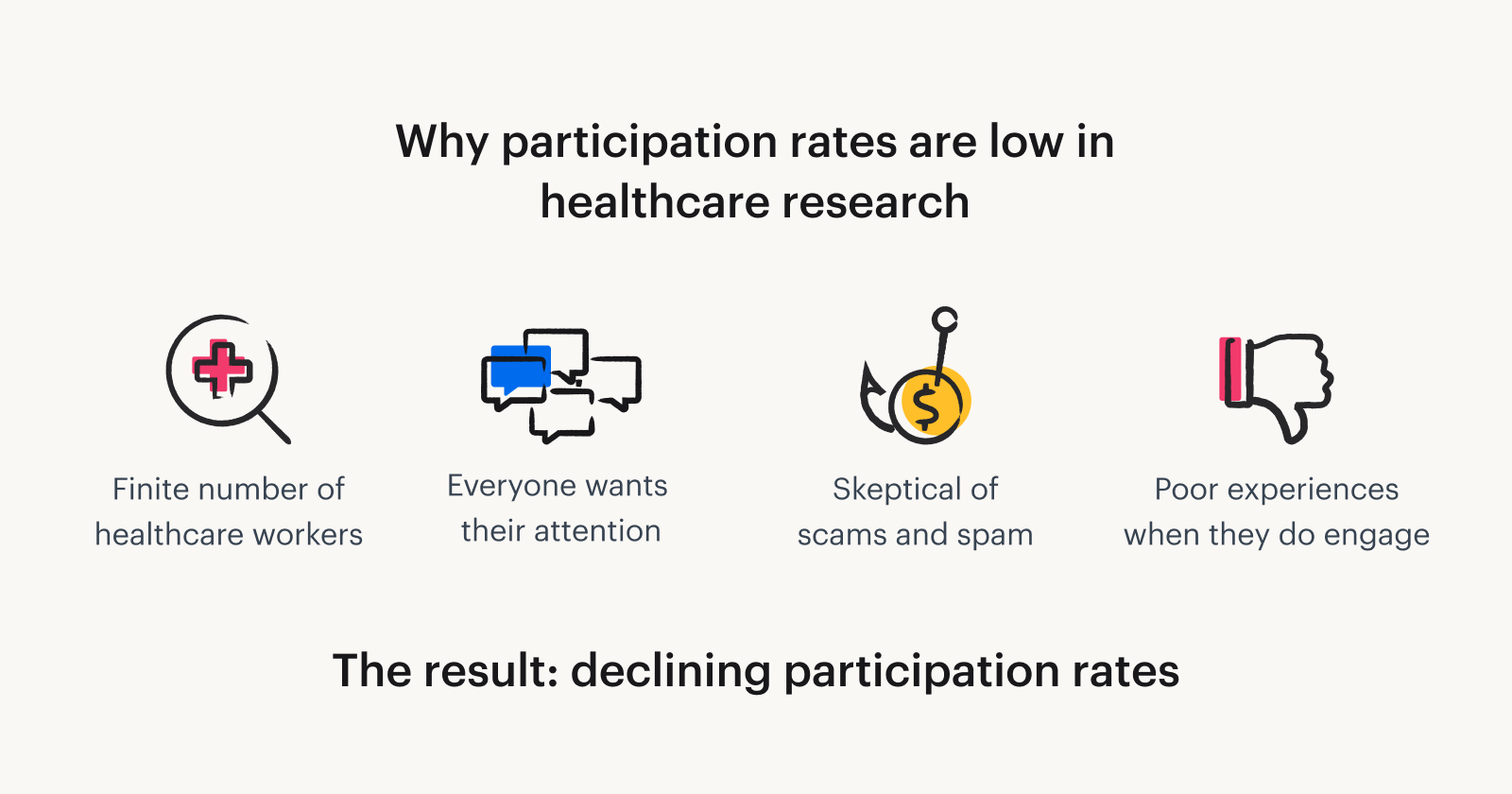

Medical professionals are often treated as if they’re an unlimited commodity, but they’re not. They’re a finite resource, particularly in the upper echelons, and many entities are vying for their attention.

Yet, for years, an ocean of researchers, marketers, salespeople, and the like have been inundating their email inboxes.

In the instances we gain their attention, there’s a lack of standardization in how we engage with these healthcare professionals. All of this has led to unopened emails, a general lack of responsiveness, and an overall decline in research participation for this highly sought-after respondent universe.

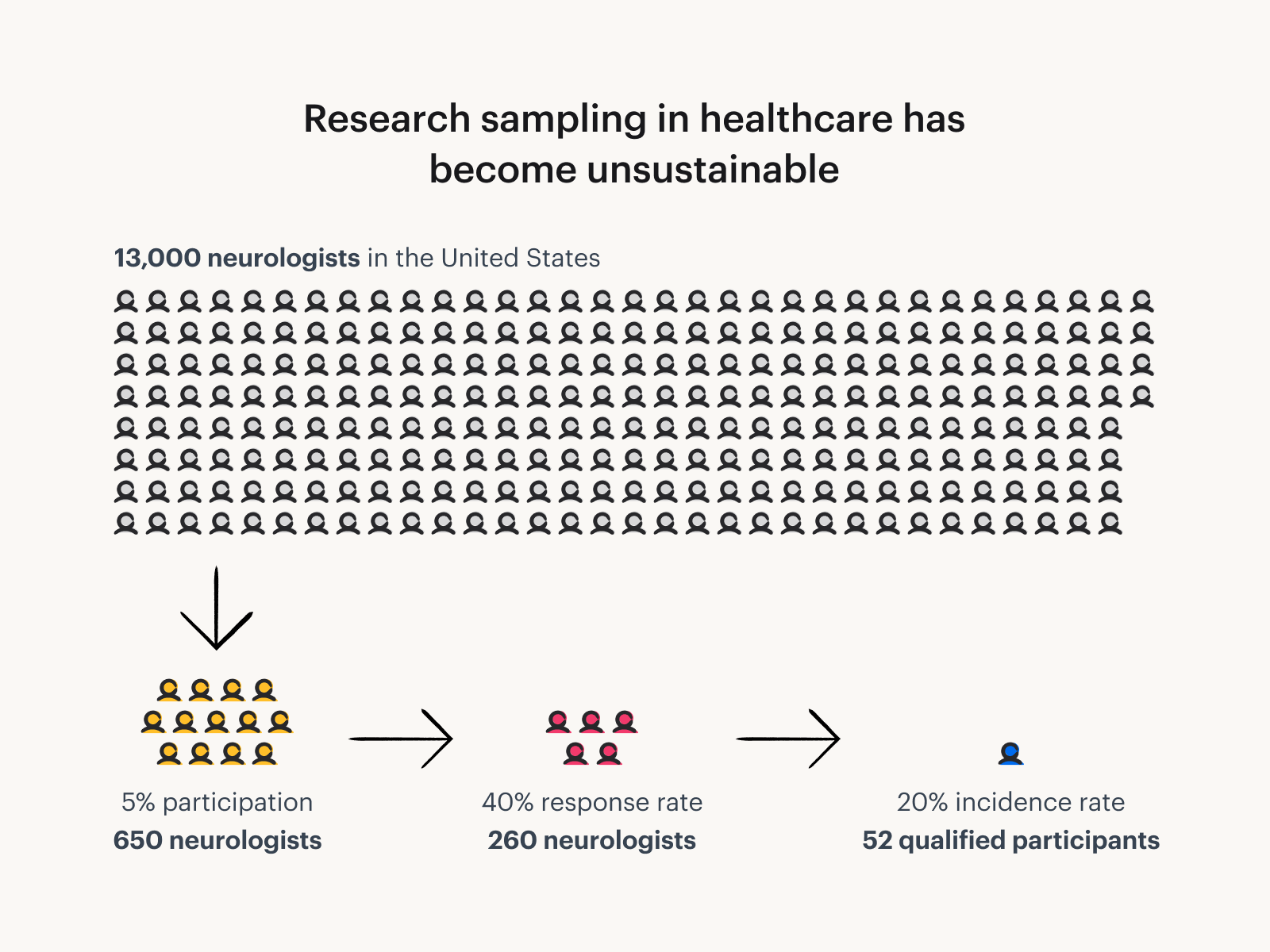

Back-of-the-napkin sample science easily explains why this is unsustainable. Take neurologists for example.

If we continue to ignore best practices, there’s an immense risk that already-low response rates will inch ever closer to zero, and our industry and the world will be the worse, for it.

But this isn’t a story of doom and gloom. At least, it doesn’t have to be. Like any ailing ecosystem, there’s a critical period where intervention can restore balance.

Over my 23-year career in market research, I’ve honed and crafted strategies for building and fostering trust and respect within my field. I’ve made it my personal mission to make a positive impact.

The successes of these strategies are evidenced today at KJT, where we have worked methodically to maintain a strong, loyal following and above-average responsiveness when sampling.

Today, I share with you some of the basic guiding principles that led to our success. Consider it a roadmap to help build a more sustainable future in the world of sampling.

Why market research in healthcare matters

In the last 20 years, U.S. healthcare systems aligned themselves around the idea of patient-centered care — meant to provide the best experience and outcomes to patients.

In reality, physicians, nurses, and other practitioners are often consumed by “the drudgery of productivity-driven assembly-line medicine,” according to a 2011 paper in the Annals of Family Medicine.

That leads to “cognitive overload and exhaustion that makes medical care anything but caring or patient-centered.”

Patient centricity requires hospital administrators, pharmaceutical companies, clinicians, and the like to have a deep, rich, and continually evolving understanding of their industry.

They need to keep track of how the healthcare industry actually works, what’s broken, and how the newest changes, trends, treatments, and medications impact patient outcomes.

Healthcare market research is central to achieving this goal and our clients have already started their push towards patient centricity.

Yet, with only a small percentage of healthcare professionals participating in market research, we have an obligation to change some common practices that impede our ability to access this population, which is extremely sparing with their free time.

If we enact commonly practiced standards around engagements, we can begin to rebuild the overall researcher-participant relationship on a foundation of mutual respect and trust.

I foresee a future where we collectively drive the industry responsiveness to double digits and beyond. Ultimately, this will unlock our ability to reach fresh, relevant respondents and expand our insights into the world of healthcare and medicine.

Rule 1: Know your population and how best to communicate with them

Reaching participants is the hardest part of any research project. It’s crucial to understand what will appeal to your target group to make it easy for them to say yes. This is especially true of any highly sought-after or already skeptical population.

Rule 2: Thoroughly QA your participant experience prior to sample launch

As a research professional, we have an obligation to rigorously review the logic and language of a survey. But we often fail to zoom out and consider the entire participant’s experience.

Take time to walk through the participant experience from a respondent perspective, ensuring every question and step is necessary. Cut everything that causes friction or confusion.

For example, one platform we use has reCAPTCHA automatically enabled. When QA’ing the respondent engagement, we realized this was an unnecessary step for specific sample sets. We set rules in place for when to appropriately use this feature.

Additionally, we adjusted when using reCAPTCHA to be mindful of the language that respondents see. Informing them that they “are human” for properly passing the security feature seems a little silly and disingenuous, therefore we removed this prompt completely.

Remember, every second spent on your survey is time spent away from patients, family, or rest. Making the process as enjoyable as possible is the key to getting respondents to re-engage and want to return to the next research opportunity.

Rule 3: When qualifying respondents, ask every screener question – even if you intend to terminate them.

Imagine this common scenario:

Your respondent enters your 10-question screener portion of the survey

On question five, the participant disqualifies, and they’re terminated before they could answer questions 6-10.

You later realize your sample is too small and you will need to cast a wider net, so you adjust criteria.

You have accessed most of the available sample, so you require those who did respond to come back and rescreen to see if they qualify this second time.

Now, you must repeat this scenario multiple times, asking terminated folks to re-screen continuously, until you achieve an ample sample size.

This poor practice burns out respondents and turns them off from responding to a future invite. Ultimately it also diminishes your ability to achieve optimal sample sizes, dropping your return rate or rescreening by 30% or more.

If a respondent is terminated 3-5 times in a short period, chances are high that they’ll ignore future invitations for any research.

Instead, ask every participant all of your questions. We often refer to this as incidence screening. If you change your qualification criteria later, you know their answers, and you can re-invite them without additional friction by notifying them that they now qualify.

Rule 4: Incentivize fairly and swiftly – consider extending to your non-qualified sample.

Show respect to each respondent by compensating appropriately while communicating clearly and thoroughly.

Within the invite, clearly identify the engagement expectations, incentive amount, and method of payment.

Incentivize immediately following an engagement, or no later than 5 business days after completion. It’s a small step with an outsized impact on the overall relationship.

Provide a host of options for collecting incentives – not everyone wants an Amazon.com gift card. The more options you provide, the better.

Find a tool that allows you to track the most popular incentives over time, to better understand your audience and support business decisions in the future.

Set standardized incentive rates and stick to them. Refrain from increasing incentive amounts as response rates drop. Nothing turns respondents off quicker than changing rates on them for each invite, or across studies.

If increasing incentives, specialized invites should accompany an explanation for the change of rate. For example, “Our goal is to close this survey within the next 48 hours, so we are offering an additional bonus of…”

Always thank respondents for their participation — a small and easy way to show mutual respect and appreciation.

If you terminate a respondent, consider compensating them for their time to respond to your request.

This will keep loyalty and engagement up and encourage respondents to return at the next opportunity.

You can minimize manual work by programmatically sending incentives to non-qualifiers via an API integration. This instant acknowledgement of their time, despite their qualification, softens the blow and provides a consolation. Another opportunity to show respect and appreciation for their loyalty to research as a whole.

By conducting incidence screening practices, you can sift through your sample for your ideal niche, while minimizing the risk of over-abusing your sample.

The best advice I can give is to always consider how the respondent will feel about the interaction, and whether it would leave them open to coming back.

KJT, as a standard practice, goes a step further in compensating our respondents when it is necessary to reschedule an interview.

Scheduling conflicts are expected and not unusual. When schedules must change, each respondent is fully compensated for their originally scheduled interview slot.

Our belief: they were courteous enough to hold that time for the research, it is only appropriate that we compensate them accordingly.

Rebuilding the ecosystem together

Healthcare market research professionals at all levels have an impact on the sampling ecosystem, and this is no different with highly incentivized, widely sought-after participants.

It’s our mission to provide insights that revolutionize our understanding of medicine, patient care, and healthcare best practices.

By putting the respondent experience first and setting standard practices, we can make a powerful impact on participation and expand our reach to fresh sample universes and insights.

About Jennifer G Hall

Jennifer is the VP of Research Operations at KJT, a healthcare market research consultancy.

She has over 20 years of experience in topics including field operations and resourcing, SOP design and implementation, on-boarding staff, multi-market logistics management, financial contract negotiations and vetting of international suppliers.

Published October 19, 2023

Updated October 19, 2023